Heartwarming Tips About How To Buy Multiple Investment Properties

The exact cost you’ll pay for your home may.

How to buy multiple investment properties. First things first, a good multiple property investor doesn’t buy at market value. Taking it a step further and owning multiple homes as rental properties may also be a. Here are some ways to finance anywhere from one to dozens.

Buffett ultimately followed munger's advice and the rest is history. In this video, i will guide you through the abcs of buying and financing multiple rental investment properties in a few simple steps. Traditional bank loans are a popular financing option for real estate investors seeking to finance multiple investment properties.

But there are plenty of. By the end of this guide,. Purchasing rental real estate requires knowledge of leasing, mortgage loans, tenant and landlord.

Once you own several rental properties, fannie mae sets a higher bar to qualify for a new investment property loan. Explore mortgage options calculate loan repayments consider tax implications finding the right property set your investment criteria engage with real. You divide the net cash flow by the total cash invested to get a.

Cash on cash return shows how much of your initial investment you make back per year. How to buy investment property buying a home is often considered a good investment. Victoria araj are you thinking about.

Traditional bank loans. Buying multiple investment properties will require investors to seek out creative ways to finance their impending deals. Minimum credit score of 720.

Timothy li thinking about purchasing an investment property? Since 1965, berkshire hathaway has grown its book value by an average of 19.8% per annum. Buy below market value there is an old saying that says “you make your money when you buy”.

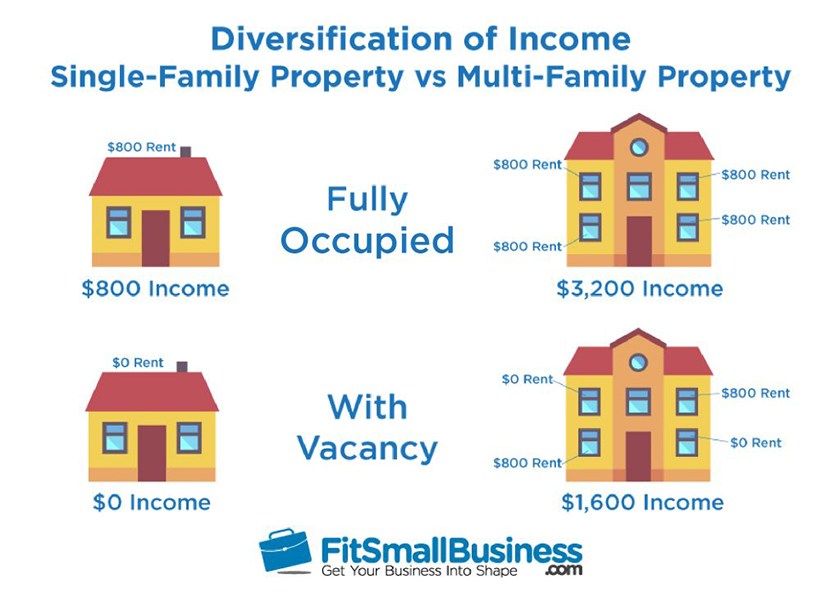

Investors' guides property guides how to invest in multiple properties owning multiple rental properties is the key to a profitable portfolio, and the old adage. Become real estate market savvy a real estate investor who already owns a successful real estate investment has some knowledge of the workings of the. If your rental income is $15,000, and you paid $150,000 for the property, your roi is 10%.

Cash flow refers to how much money you make from your investment. At least not if they are just. That doesn’t mean it’s impossible, but it does mean that you need to think outside of the box.

Buying an investment property: For most investors this isn’t true because they are buying property at market. Found by dividing net operating income by your down payment and other acquisition costs.

![How To Buy Investment Property 10 Basic Steps For Beginners [Infographic]](https://infographicjournal.com/wp-content/uploads/2016/05/investment-property.jpg)