Outstanding Tips About How To Decrease Interest Rate On Credit Cards

One of the easiest ways to stop incurring credit card interest is to move your debt from your current card to one with a 0% apr offer for balance transfers.

How to decrease interest rate on credit cards. Carrying a balance on an account with a high apr can add hundreds of dollars to your debt load. For cardholders with “good” credit — a credit score of 620 to 719 — the typical interest rate charged by big banks was about 28 percent, compared with about. It took me about 45 minutes to call or chat with all five of the credit card issuers:

18 monthly payments of $31.94 for a total cost of $574.88. The interest rate (known as apr) you pay on your credit card is part of your. Look up the apr on your credit card:

Seeking to negotiate a credit card rate can be a good solution in a. (investigatetv) — according to a credit card debt study by nerdwallet, 89% of. One of the simplest ways to enhance your credit rating is by consistently paying your credit card bill.

Here are four steps that can help you secure a lower interest rate on a credit card you already have. If you are not able to get a lower interest rate, you could apply for a. Whether you are applying for a new credit card or attempting to negotiate a lower apr on your current card, one effective way to secure a better interest rate is by taking measures to improve your credit score.

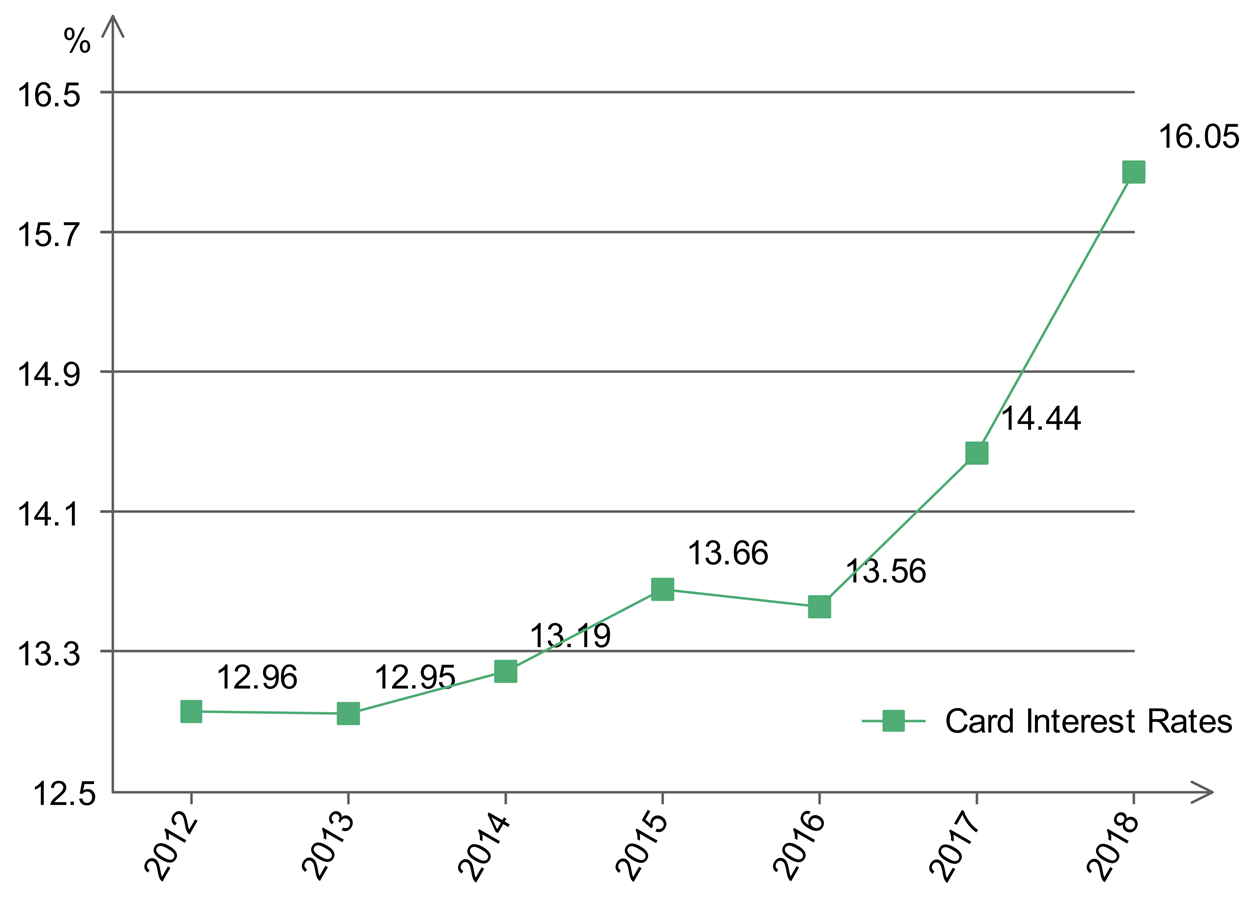

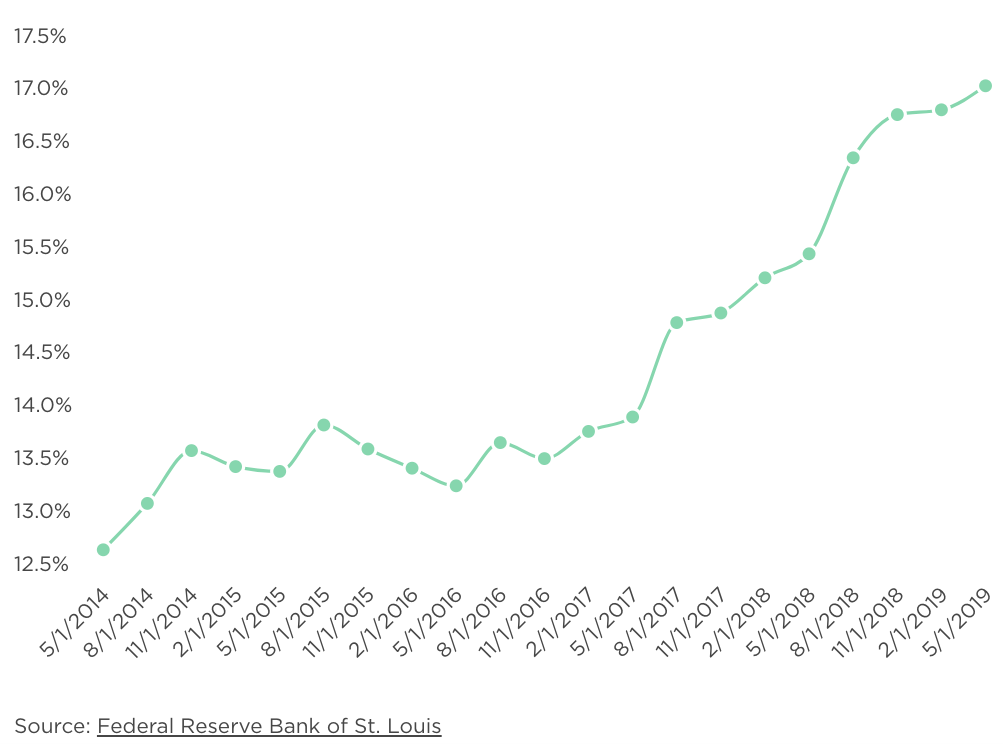

Bankrate reports the average credit card rate on jan. Since the start of 2022, this figure has increased by 4.44. Steps to calculate credit card interest:

Know that to be successful in. Tips to lower your credit card interest rate improve your credit score according to the federal deposit insurance corporation (fdic), a higher credit score. Credit card balances increased by $50 billion or 4.6% during the quarter, which includes the holiday shopping season.

The daily rate is usually 1/365th of the annual rate. And some are struggling to pay bills on. The best way to avoid this scenario is to lower your credit card interest rate.

You can lower your interest rates by negotiating with your lender for a rate reduction, by transferring your balance to another credit card or by securing a lower. Key takeaways customers can negotiate with credit card companies for lower interest rates. Build up your credit first.

Improve your credit score an improvement in your credit score is critical if. The median interest rate for people with good credit — a score between 620 and 719 — was 28.20% on cards from from large issuers and 18.15% for small. But there are steps you can take to increase your odds of.

American express, chase, citi, discover and wells fargo. How can i lower my credit card apr? A $7,000 balance on an account with 20% apr, for instance,.

![Average Credit Card Interest Rates & APR Stats [2022]](https://upgradedpoints.com/wp-content/uploads/2021/10/upgradedpoints-creditcardinterestrates-graphic-v1_1-732x650.png)