Sensational Info About How To Keep Mileage Records

February 21, 20247:36 am pstupdated 5 days ago.

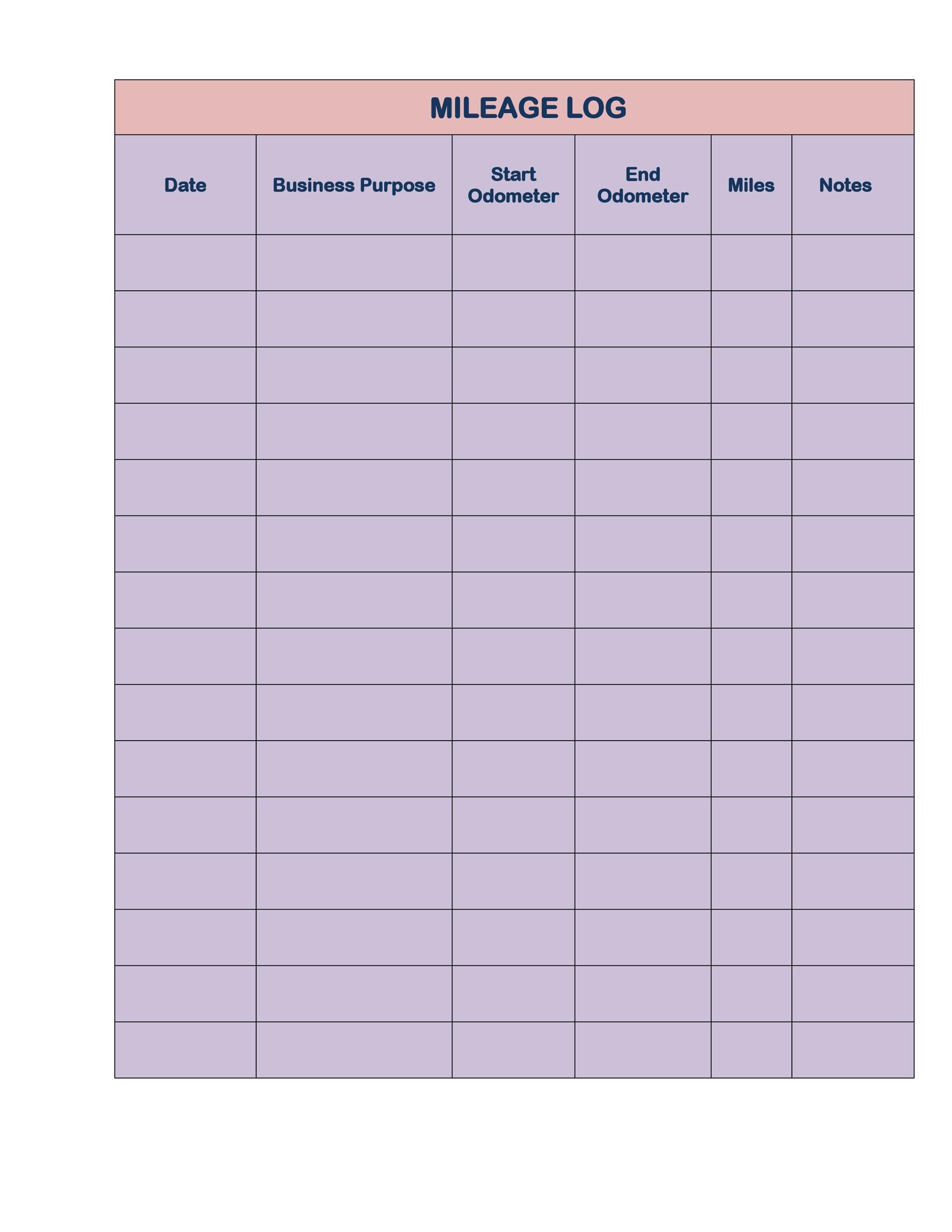

How to keep mileage records. In order to make a claim for mileage allowance relief, you need to maintain details of the journeys you have undertaken for. Doing it right a customer appointment in another city, the financing discussion at the bank, or the trip to the airport before the business trip. 23 december 2021 4 mins running a business small business operations often require travel to complete your services or meet with clients.

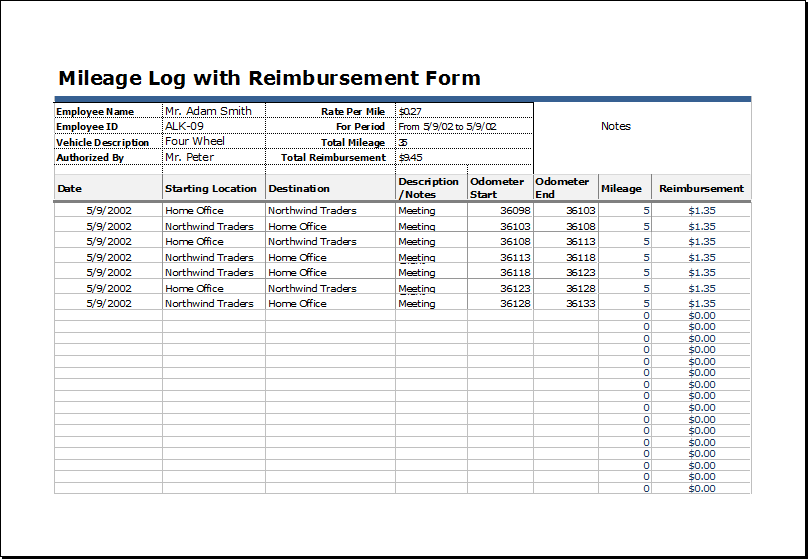

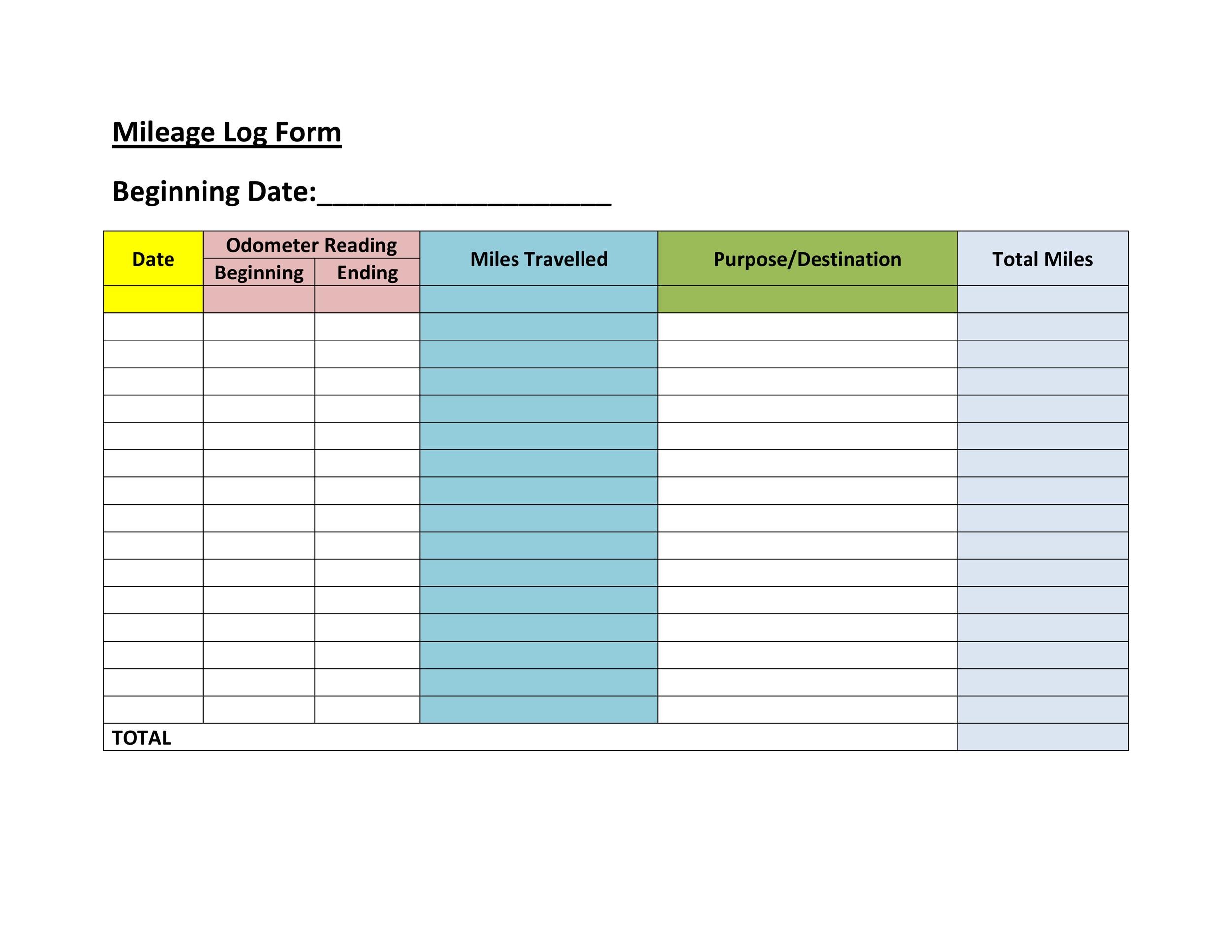

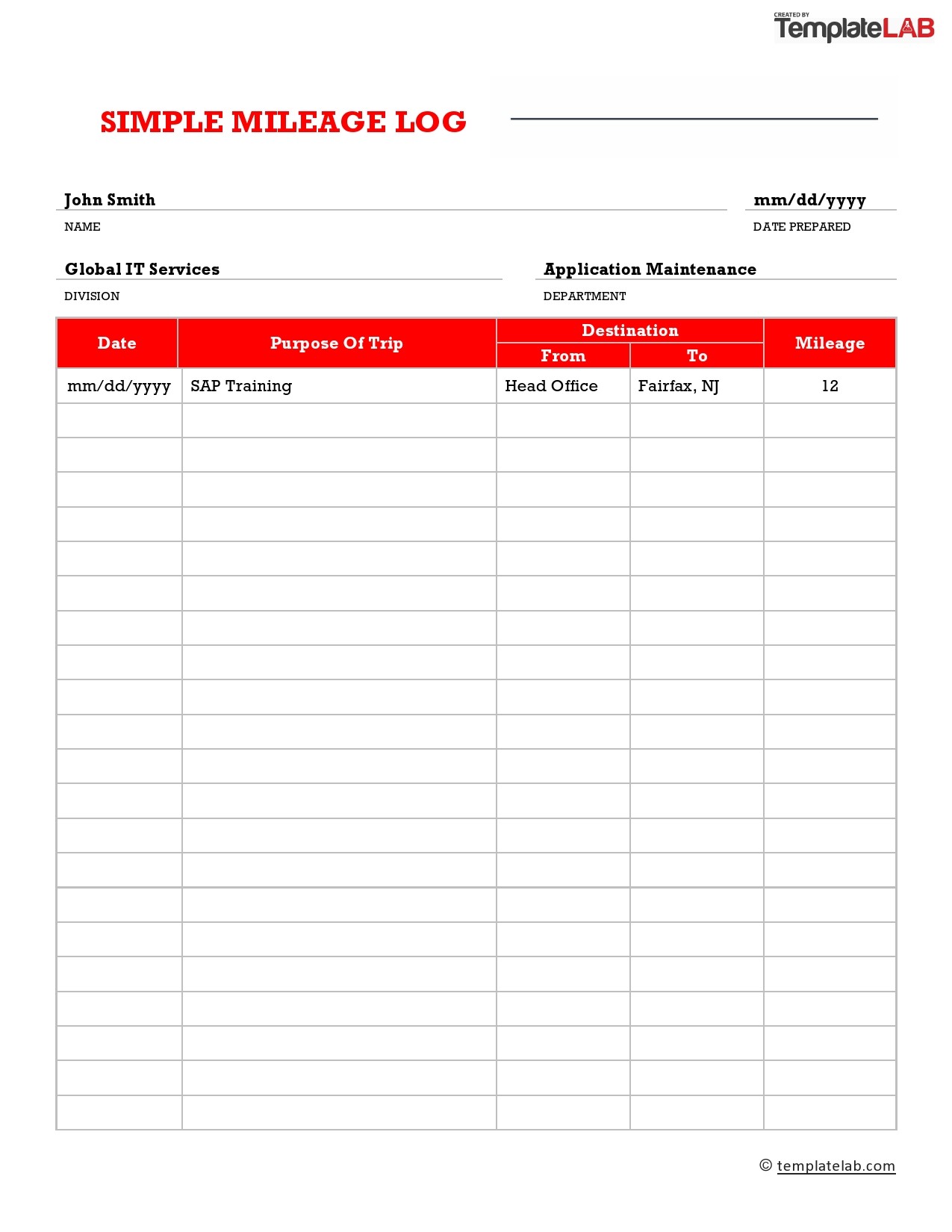

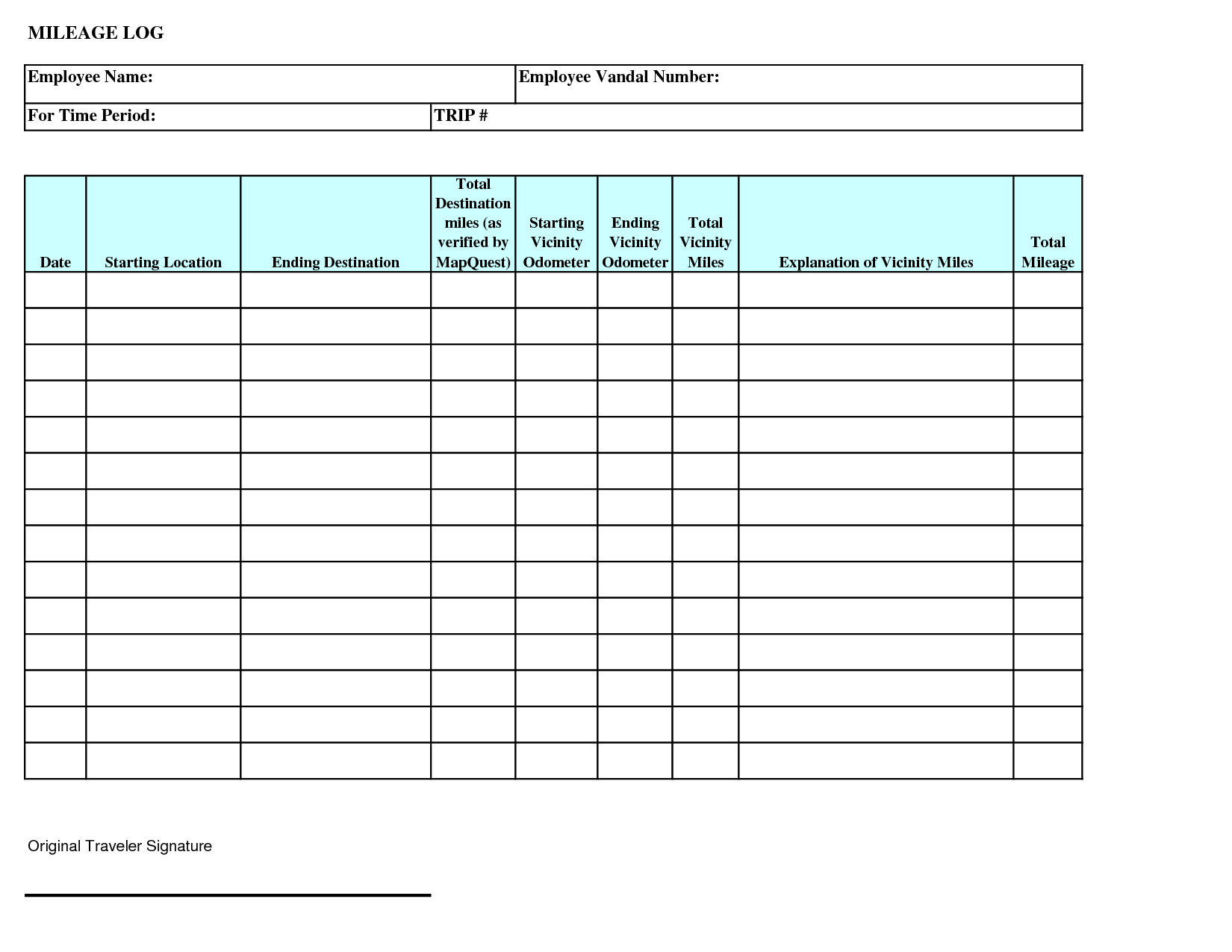

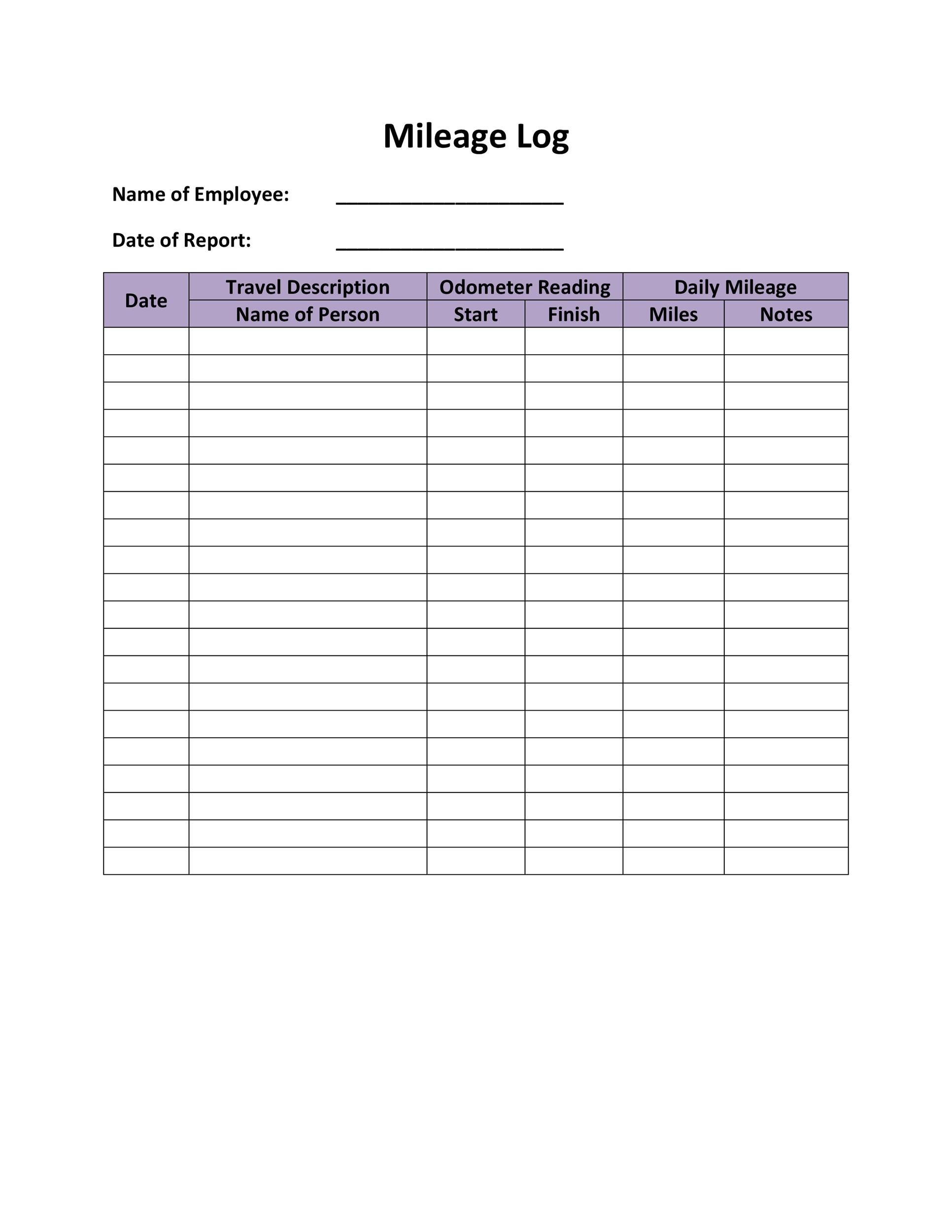

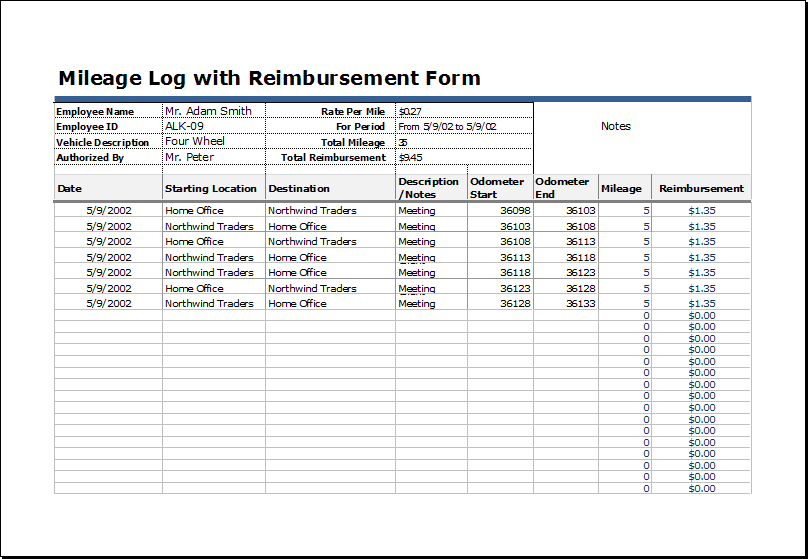

The irs provides a paper template for logging mileage, but manual trip logging is now largely considered an outdated way of keeping mileage records. Even if you use a car or other vehicle 100 percent for business, you must keep a detailed mileage log or other record. More deductions and records to keep;

Hmrc aim to visit businesses every 6 years to carry out employer compliance assurance visits. For standard mileage rate: Delayed marriage, childbirth make 30.

How to keep a mileage log: A united airlines boeing 787. The internal revenue service (irs) has two different methods for deducting driving expenses.

Therefore, it’s worth understanding how to keep your. There is no specific irs mileage log template. The mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate.

Do you want to backtrack your odometer reading for a past. That's over 200 mph as fast as a typical plane ride. Thus you can keep a simple mileage log using a standard.

What to include in your mileage logs. The most straightforward way to record business miles, and the one preferred by the irs, is to. If you need to drive for your.

Sign up with a web site dedicated to mileage tracking. What to record in your mileage. More in economy.

For the actual expense method, it's important. According to the irs, keeping a mileage log book is the most effective way to ensure that you have proof in the event of an audit. If hmrc requests proof to support the mileage deduction, you should.

The ringgit extended declines to its lowest level since the asian financial crisis, prompting malaysia’s central bank to say it doesn’t reflect the improving. The online approach is simple. The irs requires records but it doesn't dictate how you keep them.